How can medical practices turbocharge revenues despite higher patient collections?

Those were the good old days, when all your billing staff had to do was to provide an estimate of a consultation service or a medical procedure, attach the appropriate patient documents, and pass on the information to the insurance payer, who would pay the amount. But today, things are significantly different, and the main reason is that patient payment liability has gone up significantly.

Firstly, more consumers now have a deductible plan, and secondly, the patient-payable component of insurance plans has increased significantly. It is estimated that as of 2008 50% of medical plans had a deductible component as compared to 85% in 2020. Similarly, the average value of the deductible amount has increased from $735 to $ 1573 over the same period.

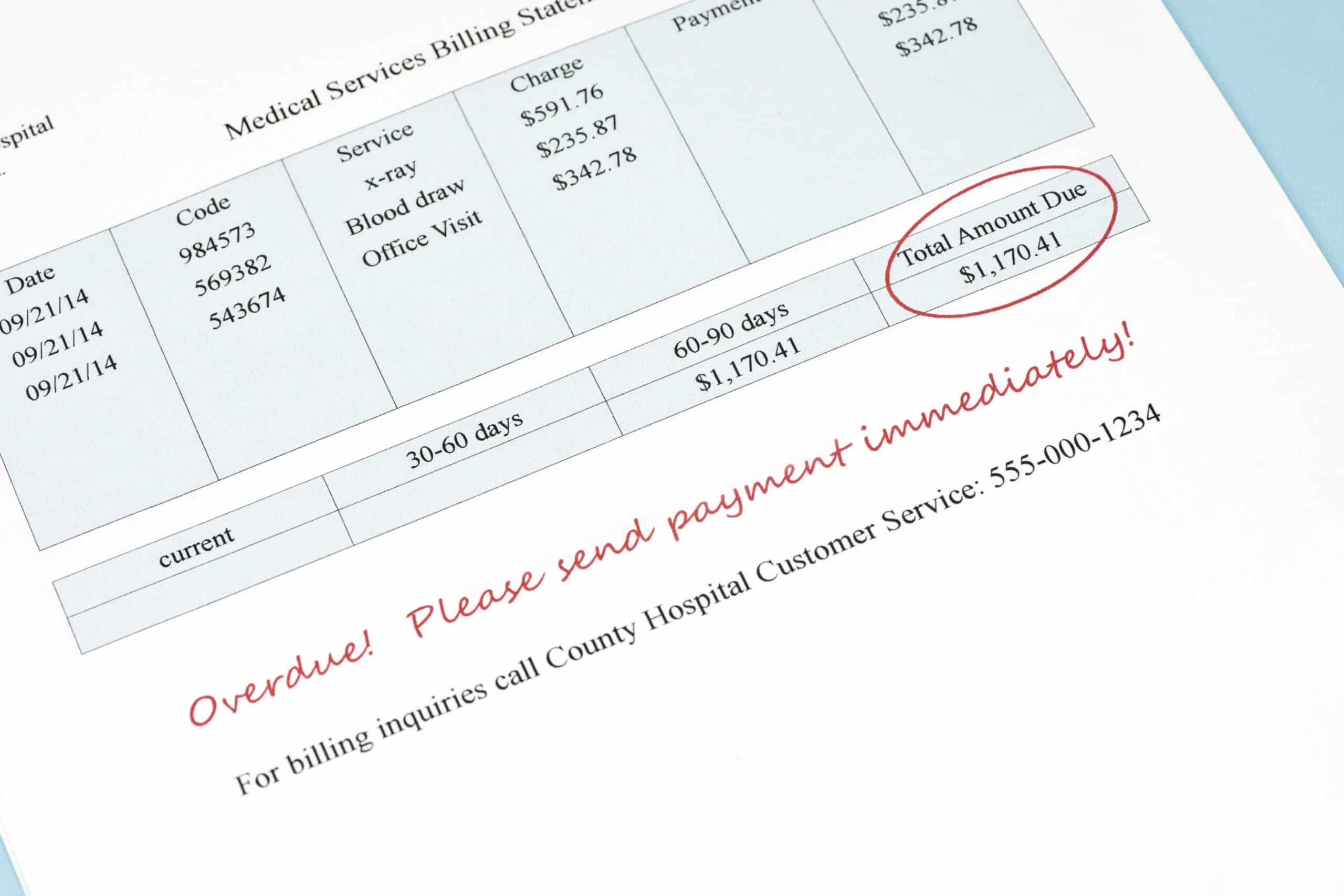

Therefore, increasingly physician practices have had to handle payment collection. That involves determining what the insurer will pay and won’t pay, raising direct customer invoices, collecting payments from clients, following up for dues, and in some cases, creating an installment payment plan. Just talking about it sounds cumbersome, we can only imagine how this trend has increased the administrative burden for physician practices. And that’s not all – it can cost you twice as much to collect from a patient as compared to a payer.

The Trends in Healthcare Payments Ninth Annual Report: 2018 from InstaMed, which includes quantitative data from more than $396 billion in healthcare payments processed on the InstaMed platform, along with survey data from consumers, providers, and payers revealed these startling trends –

- 77% of providers say that it takes more than a month to collect any payment.

- 56% of consumers would not be able to pay a medical bill of more than $1,000.

- 93% of patients were surprised by a medical bill in 2018, and

- 70% are confused by their medical bills.

Surprise medical bills can spell trouble for your practice. You will have a difficult time collecting when patients have a disconnect with the cost of a medical consult. You have greater patient dissatisfaction, and so patients are more likely to shop for an alternative the next time they need medical help. One way to ensure price transparency is to send patients a cost estimate ahead of the visit through online communication and mobile text alerts.

However, it’s estimated that more than 85% of patient billing is still paper-based. On the other hand, 80% of patients claim that they would prefer to pay for their care online – which should imply that they would be okay to receive the bill online as well.

The healthcare industry has been slow to adopt technology to improve the patient experience and streamline its administrative procedures. The difference between how most provider organizations operate and what patients expect is apparent even when patients come to the doctor’s office. We still ask patients to come in 30 to 40 minutes ahead of the scheduled time to fill in a form when the client can update the same information on an online patient portal accessible through the mobile phone.

Another case in point -Telehealth, which has been accessible and affordable for more than a decade, has become popular only through the present healthcare crisis. In contrast, industries such as banking and telecom have been more progressive in leveraging technology to improve customer experience.

Before, we move to the solutions, here is a summary of the challenges practices face in collecting payments from patients.

- Insurance plans now have a higher value of deductibles and co-pays

- There are more patients with high deductible plans.

- Many practices are still relying on archaic methods to capture patient payment information and inform them of billing procedures,

- Patients often lack clarity on payment liability.

- The surprise bills dissonance with clients and can make it more difficult for practices to collect.

- Finally, patients are obligated to make payment via check when many would prefer the convenience of online payment.

With the 2020 pandemic, we are confronted with a different world. Even in cities where the lockdown has been lifted, normalcy is yet to return, and most people continue to work from home. This means that physician practices will have to continue to offer remote consultations and start collecting payments through other methods such as an online credit card payment.

Payments are the life and blood of your practice. Delays in payment collection, and leakages from non-collection will be incredibly damaging to your profitability. So if you want to improve your patient collection process, here is what you must do.

Firstly, ensure that your patient records are accurate. Outdated information on patient insurance plans, outstanding balances, and contact details is one of the most common reasons for delays and even failures in collection. Ensure that your staff is alert to this fact and that they use every patient interaction to verify the information on record. If your medical practice management system does not reflect open balances on the patient level, consider upgrading your billing platform.

If you haven’t already implemented an online patient portal for your practice, now is the time to do so. An online patient portal will facilitate remote consultations by allowing patients to update their information online, make appointments, view payment plans, view statements, and make payments online. It’s also an excellent platform for proactive wellness education that is part of value-based care contracts.

The need of the hour is to offer multiple payment options to patients. Consider offering virtual terminals, card-on-file, which can be integrated with your patient portal, payment plans, and mobile payment solutions. Other options include IVR payments and encrypted point-of-sale devices.

A positive patient experience will increase the likelihood that a patient makes prompt payment. Every interaction a patient has with your practice impacts their perception of the experience they have had with you.

The ease of appointment booking, availability of the physician at the scheduled time, clarity of advice given, accurate patient cost estimations before service, proactive wellness advice, the flexibility of payment options, dealings with staff, the time spent in the waiting area, all of it impacts the patient experience.

A positive experience will improve the likelihood of the client making a payment. Incidentally, it will also help improve customer ratings, which will entitle you to higher payer reimbursement rates. These are some of the patient-interfacing steps you must take to improve collections.

The crucial back-end aspect you must improve is the billing and claims management processes. The last few months have been challenging. With minimal office staff support, it’s imperative that you and your remaining medical team focus on patient care.

To do that, you must consider outsourcing your medical billing and claims management to an RCM company. It can be the most time-saving and effective way to get your payments.

Outsourcing your billing and claims processes will free up time so your staff can work on more patient critical tasks. It will increase the percentage of clean claims, which means you get paid faster. An RCM partner will also work more effectively on denials management to boost your reimbursements.

Higher patient payment responsibility is the reality of healthcare today. But rather than being burdened by the administrative tasks of patient collection, physician practices can still optimize payment collection and grow revenue by (a) developing patient-centric processes, (b) using technology to update patient information and offer payment collection options, and (c) by partnering with the right RCM partner.

Request a Quote

Shoot us a message and we will generate a custom quote based on your practice needs